9Oct2023

Nicolai Tangen is a Norwegian hedge fund manager and philanthropist. Almost two decades ago, he founded AKO Capital, a British investment management fund, where he served as CEO and CIO until joining Norges Bank Investment Management three years ago. In the latter role he has managed the Norwegian Sovereign Wealth Fund, the largest publicly held financial fund in the world. While at AKO Capital, Tangen also set up the AKO Foundation 10 years ago, which supports diverse charitable endeavors, with a focus on education, the arts, and climate change.

At 57, Nicolai has a lengthy pedigree in the financial sector. He was also a partner and senior analyst at Egerton Capital and equity analyst at Cazenove & Co., and studied at the Wharton School and the London School of Economics. An avid art collector, he also obtained a bachelor’s degree in art history from the Courtauld Institute of Art at the University of London.

In his talk at the Nordic Business Forum in Helsinki, Nicolai discussed taking over the Norwegian Sovereign Wealth Fund and having dialogues with about a quarter of its staff in order to better know the team and to make more informed decisions. “You want to get as many data points as you can, so that when you make decisions, they are better, and then when you make changes, they are all on board,” Nicolai said of his approach.

Based on those discussions, he determined that he needed to focus on performance, people, and communication. To improve all three, he laid out multiple points in his talk at the forum. He noted that managers need to focus on making fewer decisions, but those that have long-lasting results. They also need to know what they own, so they can make better-informed decisions.

Making Better Choices

Nicolai related how one of the analysts at his previous firm took a course in plumber education, as the company owned a plumbing business. By understanding what it meant to be a plumber, the analyst could make better choices. He also developed “fantastic relationships,” said Nicolai.

There must also be a willingness to learn from mistakes. Within the Norwegian Sovereign Wealth Fund, portfolio managers have begun to compile data on their decisions. This information can be used to make future decisions. “Say you want to buy $1 million of Apple, and before you do that, it tells you that you have never made money in Apple,” he said as an example. “You have to look at your mistakes before you can press the button,” said Nicolai.

Going Against the Grain

Managers also need to be more contrarian. They are more likely to be successful when they are right, but that nobody agrees on their position. “That’s a really profitable place to be,” said Nicolai. “You have to do stuff that nobody agrees with.” Another aspect of performance is working on one’s psyche. He noted that the fund works with sports psychologists, who have helped staff to develop the ability to bounce back and to focus on the process, not the results.

In terms of people, Tangen said that contrarian ideas have to be supported, and that people should feel comfortable offering alternatives. “To have such an environment is key to creativity,” he said, “because if you don’t feel safe, you are never going to create that kind of environment in the office.” Nicolai also said that employees should understand that 90% is often good enough. Overdoing in any way, putting in 100%, can be actually costly and take more time. Leaders should also be willing to make mistakes, said Nicolai. He said that if leaders typically make good decisions, but admit failure sometimes, it actually reinforces faith in their judgment.

In Search of Sisu

Then there is grit, or what the Finns call sisu. Nicolai said that grit is a “big explanatory factor” for why some are successful and some are not. Managers can seek out people with grit by identifying candidates who have had rougher upbringings, or come from difficult areas, which has forced them to be more self-reliant and resilient. Those who work on what excites them, a personal passion, are also more likely to exhibit grittiness, as they are personally invested in what they are doing.

Nicolai encourages lifelong learning among employees. He noted that Bill Gates often has dinner with specialists multiple nights a week to get better insights into various topics of interest.

“There is a lot of scope here for cranking up the learning,” Nicolai insisted. “You need to challenge yourself all the time. You need to read widely because the more different things you know, the better you can combine different things into new thinking and the more interesting a person you become.”

Communicate, Communicate, Communicate!

Finally, communication is important. The best companies are the companies where information flows well, said Nicolai. Within the fund, meeting notes are now transcribed, published and shared, all with the help of AI. Their LinkedIn account is also a good vehicle for communication.

And don’t forget to have fun, Nicolai urged the audience. “Firms where people have fun perform better,” he said. He said that having fun is part of the fund’s strategy document. Artificial intelligence, he added, is going to provide companies with more opportunities to have fun.

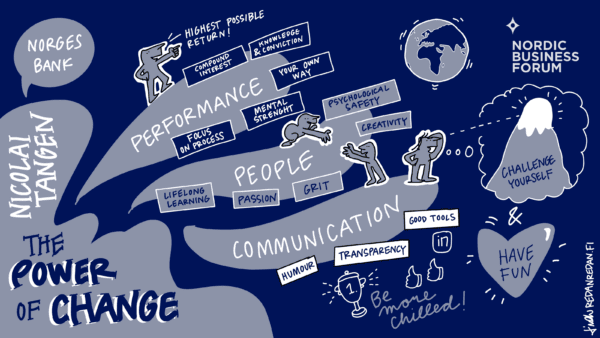

Visual summary of Nicolai Tangen’s keynote by Linda Saukko-Rauta

Want to get the full summary of the Nordic Business Forum 2023 speeches + extra content for reflecting on your learning? Download your free copy of the full Executive Summary and summaries from previous events!